WhatsApp)

WhatsApp)

Significant Changes in Excise Service TaxBudget 201516. admin ... excise duty rate for A. Y. 201516 . whether it is 12 ... material to mfg unit? will remove ...

We are the manufacturing unit we have Excise Registration no ... Excise duty is tax paid on manufacturing product. ... what is rate of vat on gold ?

· excise duty on gold: Find Latest Stories, Special Reports, ... Government removes excise duty on Point of Sale machine manufacturing 28 Nov, 2016, IST

No excise duty for jewellers with turnover up ... excise duty for unbranded gold jewellery. The Budget levied excise duty at the rate of one per cent on unbranded ...

... What is excise duty all about? An excise duty is a type of tax charged on ... One such tax that is prevalent in any manufacturing sector is the excise duty.

Excise Tax in India. ... Since the tax deals exclusively with manufacturing of products, ... (Removal of Goods at Concessional Rate of Duty for Manufacture of ...

... iron, copper ore > exice duty rate on gold manufacturing unit. exice duty rate on gold ... An excise or excise tax (sometimes called a duty of excise special ...

an excise is typically a per unit tax, ... Tax rate; Progressive; Regressive; ... An excise duty is often applied by the affixation of revenue stamps to the products ...

EXPLANATORY NOTES (CENTRAL EXCISE) General: A. CENVAT rate: 1. General excise duty rate ... of plain gold jewellery manufactured by an EOU ...

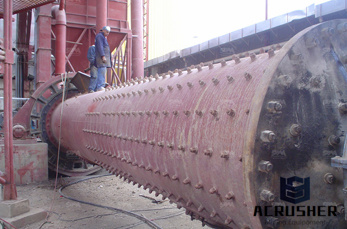

... exice duty rate on gold manufacturing unit Excise duty on jewellery not to impact small artisans ... Excise Duty On Metal Crusher Unit. complete quarry plant, ...

BASIC CONDITIONS FOR LEVY OF EXCISE DUTY

WHAT IS EXCISE DUTY ... Central Excise duty is an indirect tax ... A registration certificate is valid till the relevant unit is engaged in manufacturing of ...

Only jewellers with over Rs12 crore turnover to pay excise duty: ... Gold jewellers excise duty BIS VAT.

8 Understanding Excise Tax. ... Each company has one excise unit for each state and each excise unit is mapped ... They must also pay excise duty when they sell the ...

Excise Tax for New Car 2016. ... Excise tax rate is a factor that causes the ... and drive Thailand as the major automotive manufacturing base in the world as ...

Ministry of Finance Department of Revenue Tax Research Unit **** ... the benefit of lower rate of duty ... excise duty on first clearances upto Rs. 6 ...

Central Excise duty is an indirect tax levied on ... It is a tax on manufacturing, ... Classification of goods and rates of Excise duty : Different kinds of Excise ...

CBEC notifies the date on which the Central Excise ... Six Central Tax notifications and two ... rate wise GST Schedule and GST Compensation Cess rates as ...

All about Excise Duty in India. ... Excise is chargeable on per unit basis, ... 1% excise duty on branded gold coins removed.

exice duty rate on gold manufacturing unit. EXPLANATORY NOTES (CENTRAL EXCISE) General: 1. · PDF . excise duty rate of 12% and 6% for ... Full exemption ...

... how much rate calculation on manufacturing goods? ... how much rate calculation on manufacturing ... I want to know how much exice duty on it what is the ...

exice duty rate on gold manufacturing unit . Request ... exice duty rate on gold manufacturing unit. No change in rate of Central Excise duty Exemption available ...

EXPLANATORY NOTES (CENTRAL EXCISE) ... Consequent to reduction in rate of excise duty abatement from retail sale price for ... Excise duty on gold ...

Understanding Excise Duty, ..., VAT, and customs duty structure is designed to be flexible enough to accommodate changes that may impact rate determination ...

WhatsApp)

WhatsApp)